After 3 days of world marketplace turmoil now not observed for the reason that early days of the Covid-19 pandemic, shares in Asia regained a measure of calm on Tuesday in spite of little let up within the escalating business tensions led to by way of President Trump’s price lists.

Ahead of markets opened in China, the federal government unleashed a sequence of measures to stabilize shares. In flip, proportion costs in Hong Kong, an afternoon after plunging 13.2 p.c, rose 2 p.c. Benchmarks in mainland China ticked increased, recuperating from giant declines the day prior to.

In Japan, the Nikkei 225, a key benchmark in Japan, won 6 p.c, recouping a portion of the former days losses. The uptick in sentiment adopted feedback made on Monday by way of Treasury Secretary Scott Bessent, who stated he would quickly start discussions with the Jap authorities referring to price lists.

The Kospi index rose in South Korea rose about 1.5 p.c.

Markets world wide had been unmoored closing week by way of Mr. Trump’s announcement of extensive new price lists — a base tax of 10 p.c on American imports, plus considerably increased charges on dozens of alternative international locations. Nations have spoke back with price lists of their very own on U.S. items, or with threats of retaliation. China retaliated forcefully on Friday, matching a brand new 34 p.c tariff with one in all its personal on many American imports.

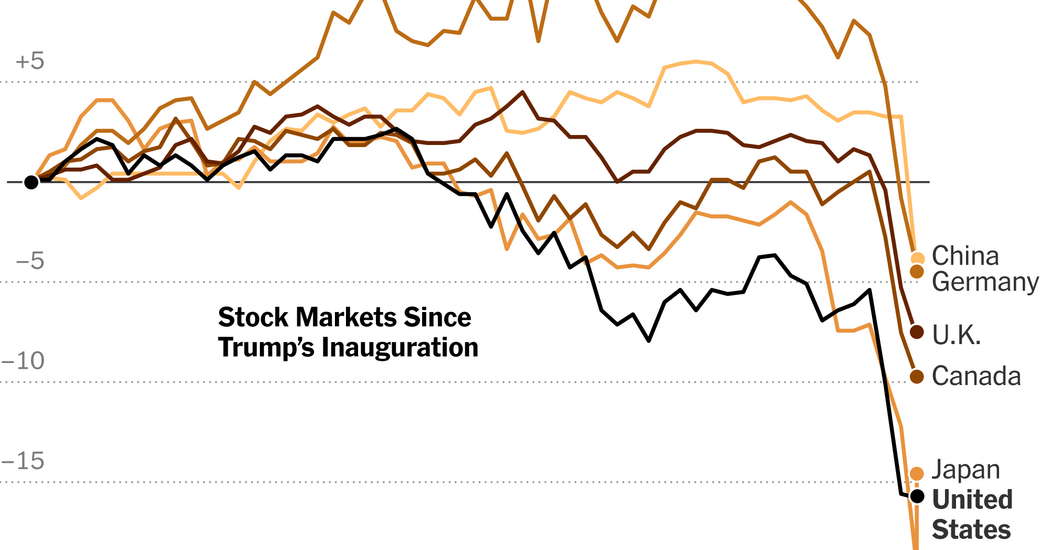

In the USA on Monday, the S&P 500 fell 0.2 p.c after tumultuous buying and selling that at one level pulled the benchmark into bear market territory, or a drop of 20 p.c or extra from its contemporary prime. S&P futures, indicating how markets may carry out once they reopen for buying and selling on Wednesday in New York, had been 1.5 p.c increased.

Wall Boulevard executives and analysts are rising more and more nervous that escalating business tensions may just do lasting harm to the worldwide financial system.

“The faster this factor is resolved, the simpler as a result of probably the most uncomfortable side effects building up cumulatively over the years and could be laborious to opposite,” Jamie Dimon, the manager govt of JPMorgan Chase, wrote in his annual letter to shareholders on Monday. Some financial institution economists are already forecasting that the financial system will slip into recession later this 12 months.

The ten.5 p.c drop within the S&P 500 on Thursday and Friday used to be the worst two-day decline for the index for the reason that onset of the coronavirus pandemic in 2020.

With the brand new higher-rate price lists set to enter impact on Wednesday, Mr. Trump has remained unrelenting on his business stance. On Monday he issued a brand new ultimatum to China to rescind its retaliatory price lists on the USA, or face additional tariffs of 50 percent beginning Wednesday.

However China confirmed on Tuesday that it isn’t relenting.

A number of authorities departments and government-owned enterprises issued statements and pledged to “take care of the sleek operation of the capital marketplace.” And the Other people’s Financial institution of China, the rustic’s central financial institution, vowed to make stronger Central Huijin Funding, the arm of China’s sovereign wealth fund that stated it used to be expanding its holdings of inventory price range.

As well as, seven corporations affiliated with China Traders Crew, a big company owned by way of the central authorities that trades in Hong Kong, stated they’d boost up a plan to shop for again a few of its stocks, a transfer that normally lifts inventory costs.

The strikes by way of what’s referred to as China’s “nationwide crew” had been paying homage to efforts Beijing took all through a marketplace disaster in 2015.

On the time, the Chinese language authorities’s efforts to shore up inventory costs got here after its personal misjudged steps to spice up after which cool costs. This time, Beijing’s intervention seems to chime with a method by way of the Chinese language chief, Xi Jinping, of presenting his authorities as a pillar of secure calm in opposition to the worldwide financial turbulence unleashed by way of Mr. Trump’s price lists.

Christopher Buckley and River Akira Davis contributed reporting.