Tax season is finished.

And this yr, Congressional Republicans transformed tax season to “gross sales” season. Republicans and President Donald Trump are pushing to approve a invoice to reauthorize his 2017 tax lower package deal. Another way, the ones taxes expire later this yr.

“We completely must make the tax cuts everlasting,” mentioned Rep. Tom Tiffany, R-Wis., on FOX Trade.

“Now we have were given to get the renewal of the President’s Tax Cuts and Jobs Act. That is completely crucial,” mentioned Sen. Mike Rounds, R-S.D., on FOX Trade.

Charges for almost each and every American spike if Congress doesn’t act inside the following few months.

CONFIDENCE IN DEMOCRATS HITS ALL TIME LOW IN NEW POLL

Speaker of the Space Mike Johnson, R-L. a.., talks with the media after the Space handed the finances answer on Thursday, April 10, 2025. (Tom Williams/CQ-Roll Name, Inc by means of Getty Photographs)

“We’re seeking to keep away from tax will increase at the maximum prone populations in our nation,” mentioned Rep. Beth Van Duyne, R-Texas, a member of the Space Tactics and Method Committee which determines tax coverage. “I’m seeking to keep away from a recession.”

If Congress stumbles, the non-partisan Tax Basis estimates {that a} married couple with two kids – incomes $165,000 a yr – is slapped with an additional $2,400 in taxes. A unmarried dad or mum and not using a children making $75,000 every year may see a $1,700 upcharge on their tax invoice. A unmarried dad or mum with two kids bringing house $52,000 a yr will get slapped with an extra $1,400 in taxes a yr.

“Beautiful vital. That is an additional mortgage payment or further hire fee,” mentioned Daniel Bunn of the non-partisan Tax Basis. “Other folks were more or less used to residing with the insurance policies which might be lately in legislation for just about 8 years now. And the shift again to the coverage that was once previous to the 2017 tax cuts can be a dramatic tax build up for plenty of.”

However technically, Republicans aren’t reducing taxes.

“So simple as I will be able to make this invoice. It’s about maintaining tax charges the similar,” mentioned Sen. James Lankford, R-Oklahoma, on Fox.

Congress needed to write the 2017 tax aid invoice in some way in order that the discounts would expire this yr. That was once for accounting functions. Congress didn’t must rely the tax cuts towards the deficit thank you to a few tough number-crunching mechanisms – as long as they expired inside a multi-year window. However the outcome was once that taxes may climb if lawmakers didn’t renew the outdated discounts.

“It sunsets and so that you simply robotically return to the tax ranges previous to 2017,” mentioned Sen. Chuck Grassley, R-Iowa.

A contemporary Fox Information ballot discovered that 45% of the ones surveyed – and 44% of independents imagine the wealthy don’t pay sufficient taxes.

Democrats hope to show outrage concerning the perceived tax disparity towards Trump.

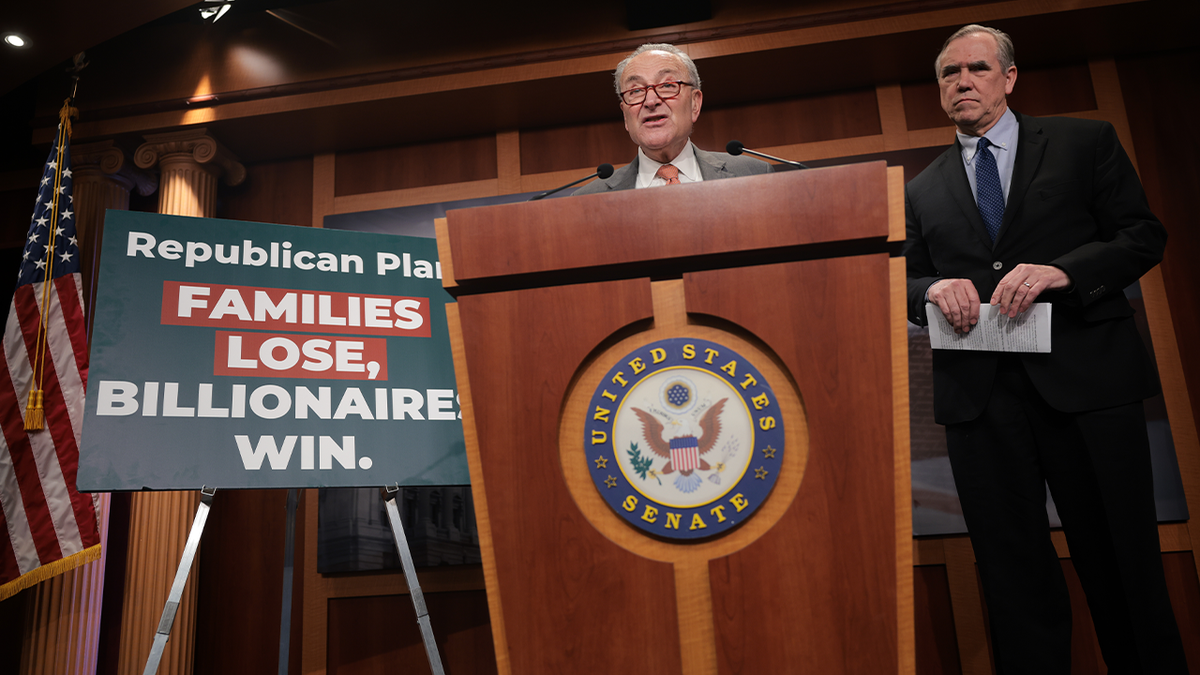

“He needs his billionaire friends to get an excellent larger tax damage. Is that disgraceful?” requested Senate Minority Chief Chuck Schumer, D-N.Y., at a rally in New York.

“Shame!” shouted any individual within the crowd.

“Disgraceful! Disgraceful!” adopted up Schumer.

U.S. Senate Minority Chief Chuck Schumer, D-N.Y., (R) speaks along Sen. Jeff Merkley, D-Ore., (L) to journalists all through a information convention at the affects of the Republican finances proposal on the U.S. Capitol on April 10, 2025 in Washington, DC. (Kayla Bartkowski/Getty Photographs)

Some Republicans are actually exploring elevating charges at the rich or companies. There’s been chatter on Capitol Hill and within the management about exploring an extra set of tax brackets.

“I do not imagine the president has made a resolution on whether or not he helps it or now not,” mentioned White House spokeswoman Karoline Leavitt.

“We’re going to look the place the President is” in this, mentioned Treasury Secretary Scott Bessent whilst touring in Argentina. “The entirety is at the desk.”

A Treasury spokesperson then clarified Bessent’s remarks.

“What’s off the desk is a $4.4 trillion tax build up at the American other folks,” mentioned the spokesperson. “Moreover, company tax cuts will activate a producing growth and all of a sudden develop the U.S. financial system once more.”

Best Congressional GOP leaders pushed aside the theory.

“I’m now not a large fan of doing that,” mentioned Space Speaker Mike Johnson on Fox. “I imply we are the Republican birthday celebration and we are for tax aid for everybody.”

FEDERAL JUDGE TEMPORARILY RESTRICTS DOGE ACCESS TO PERSONALIZED SOCIAL SECURITY DATA

“I don’t toughen that initiative,” mentioned Space Majority Chief Steve Scalise, R-L. a.., on FOX Trade, ahead of including “the whole lot’s at the desk.”

However when you’re President Donald Trump and the GOP, believe the politics of making a brand new company tax charge or mountain climbing taxes at the well-to-do.

Break of day mild hits the U.S. Capitol dome on Thursday, January 2, 2025, because the 119th Congress is about to start Friday. (Invoice Clark/CQ-Roll Name, Inc by means of Getty Photographs)

The president has expanded the GOP base. Republicans are now not the birthday celebration of the “rich.” Handbook laborers, store and storekeepers and small trade individuals now contain Trump’s GOP. So keeping up those tax cuts is helping with that working-class core. Elevating taxes at the rich would assist Republicans pay for the tax cuts and scale back the hit at the deficit. And it could defend Republicans from the Democrats’ argument that the tax cuts are for the wealthy.

Congress is now in the course of a two-week recess for Passover and Easter. GOP lawmakers and workforce are operating at the back of the scenes to if truth be told write the invoice. No person is aware of precisely what is going to be within the invoice. Trump promised no taxes on guidelines for meals carrier staff. There may be communicate of no taxes on extra time.

WHITE HOUSE PHOTO BLUNTLY SHOWS WHERE PARTIES STAND ON IMMIGRATION AMID ABREGO GARCIA DEPORTATION

Republicans from high-tax states like New York and Pennsylvania wish to see a discount of “SALT.” That’s the place taxpayers can write off “state and native taxes.” This provision is an important to safe the toughen of Republicans like Reps. Nicole Malliotakis, R-N.Y., and Mike Lawler, R-N.Y. However together with the SALT aid additionally will increase the deficit.

So what is going to the invoice appear to be?

“Minor changes inside which might be naturally at the desk,” mentioned Rounds. “The important thing although, [is] 218 within the Space and 51 within the Senate.”

In different phrases, it’s concerning the math. Republicans want to expand the fitting legislative brew which instructions simply the correct amount of votes in each chambers to go. That might imply together with sure provisions – or dumping others. It’s difficult. Particularly with the narrow Space majority.

Other folks attend a press convention and rally in toughen of truthful taxation close to the U.S. Capitol in Washington, D.C. on April 10, 2025. (Bryan Dozier / Heart East Photographs / Heart East Photographs by means of AFP)

“There have been trade-offs and offsets inside that invoice that many of us are disappointed with,” mentioned Bunn of the 2017 invoice. “And it is not transparent how the package deal goes to return along with the ones more than a few trade-offs.”

Johnson needs the invoice entire by way of Memorial Day. Republicans know this endeavor can’t drag on too past due into the yr. Taxpayers would see a tax build up – even supposing it’s brief – if understanding the invoice stretches into the autumn when the IRS starts to organize for the following tax season.

It’s additionally idea that completing this faster quite than later would offer some balance to the risky inventory markets. Setting up tax coverage for subsequent yr would calm anxieties concerning the country’s financial outlook.

“The large, gorgeous invoice,” Trump calls it, including he needs the law finished “quickly.”

CLICK HERE TO GET THE FOX NEWS APP

And that’s why tax season is now gross sales season. Each to the lawmakers. And to the general public.