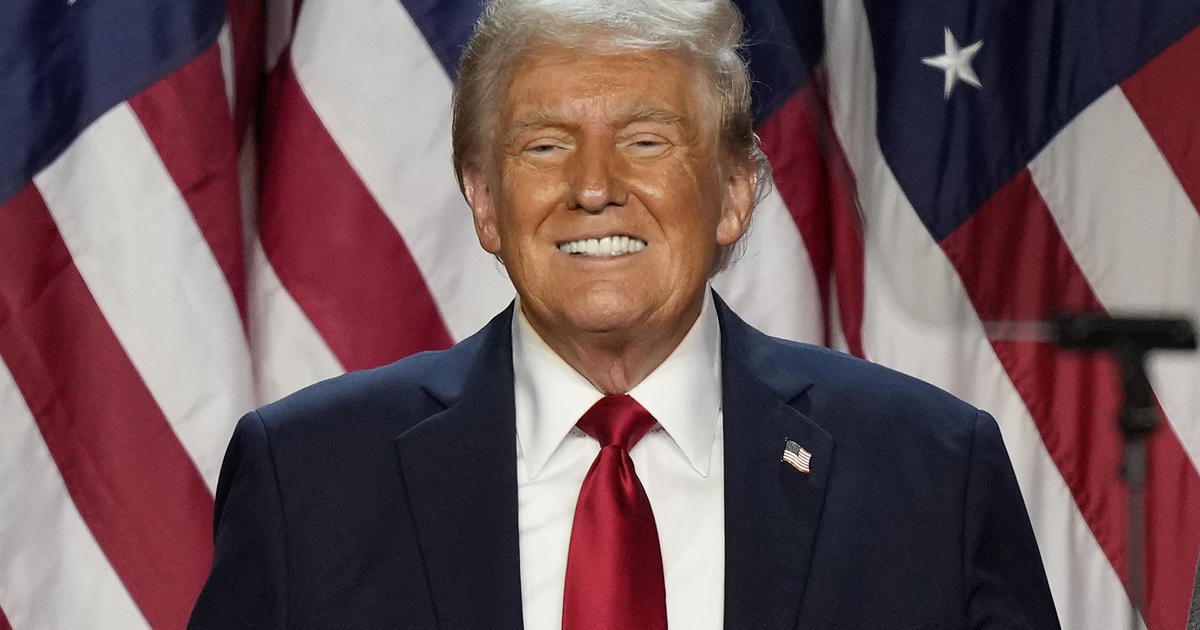

President-elect Donald Trump’s victory within the November 5 election highlights the frustrations of thousands and thousands of citizens, with many American citizens noting in exit polls on Tuesday that they are nonetheless hurting from the absolute best inflation in 40 years and upset with the country’s financial trajectory.

Trump ran on a marketing campaign that vowed to take on the ones problems, pledging to end the “inflation nightmare” and to deliver costs down “in no time.” He additionally presented a myriad of tax cuts to quite a lot of teams, starting from senior citizens to homeowners, in addition to to finance a few of the ones cuts thru new tariffs on imports from China and different international locations and to deport millions of undocumented immigrants.

Within the aftermath of Trump’s win, economists and coverage professionals are assessing how the ones insurance policies would possibly affect the financial system in addition to customers’ wallets. Already, Wall Boulevard is predicting that his insurance policies may just spice up company expansion, sending the S&P 500 higher by means of up to 2.2% on Wednesday.

However some professionals observe Trump’s plans might also spice up inflation, doubtlessly hurting customers who’re hoping for aid on the checkout counter.

“The satan will likely be in the main points,” Ed Generators, Washington coverage analyst at funding financial institution Raymond James, advised CBS MoneyWatch. “The Trump tax, industry, tariff and immigration time table can have important financial affects and lift considerations a couple of 2d wave of inflation.”

Alternatively, compromises or alterations to his plans “may just mitigate the affect,” Generators added.

To make certain, whether or not Trump can reply to citizens’ maximum urgent financial problems is not positive, particularly if the Area of Representatives flips to Democratic keep an eye on, which might stymie his plans to increase tax cuts that had been enacted in his 2017 Tax Cuts & Jobs Act (TCJA) in addition to to enact different adjustments.

Listed here are 5 tactics Trump’s insurance policies may just affect the financial system and your cash.

Your cash below Trump’s tax plans

The core of Trump’s tax plan is to increase the provisions within the TCJA which are set to run out on the finish of 2025. Those come with the legislation’s diminished tax brackets and expanded usual deduction.

Trump additionally needs to supply deeper tax cuts for some people and companies, along with his marketing campaign proposing reducing the company tax fee to fifteen% from its present 21%. He is floated the speculation of getting rid of non-public revenue taxes on many kinds of income, from tricks to Social Safety advantages, however has but to provide main points.

Trump’s mixture of price lists and tax cuts, would rank because the sixth-biggest tax reduce since 1940, in line with a up to date Tax Basis analysis.

If Trump is in a position to enact those tax code adjustments, non-public revenue taxes would decline for all revenue teams. However the best beneficiaries can be high-income families, in line with an research from the Penn Wharton Finances Fashion (That analysis assesses Trump’s proposed tax cuts however does not come with the affect of price lists.)

That suggests a middle-class circle of relatives with income of about $80,000 a yr would get a tax smash of about $1,740 in 2026, the research discovered. Most sensible-earning families, with earning of greater than $14 million, would see their taxes decreased by means of $376,910, in line with Penn Wharton.

What may just occur with inflation?

Shoppers rank inflation as considered one of their best financial considerations, with many nonetheless feeling affect of hovering costs all the way through the pandemic. Even if the U.S. inflation fee has now fallen on the subject of the Federal Reserve’s 2% annual goal, many American citizens nonetheless describe it as excessive as a result of costs have not come down; quite, costs are merely emerging extra slowly than they did all the way through the pandemic.

Economists have cautioned that Trump’s plans may just reignite inflation. That is as a result of price lists are necessarily gross sales taxes paid by means of American customers, quite than the nations that export items to the U.S. On best of that, Trump’s plan to deport thousands and thousands of immigrants may just additionally spice up inflation as employers would most likely face upper wages because of a hard work crunch.

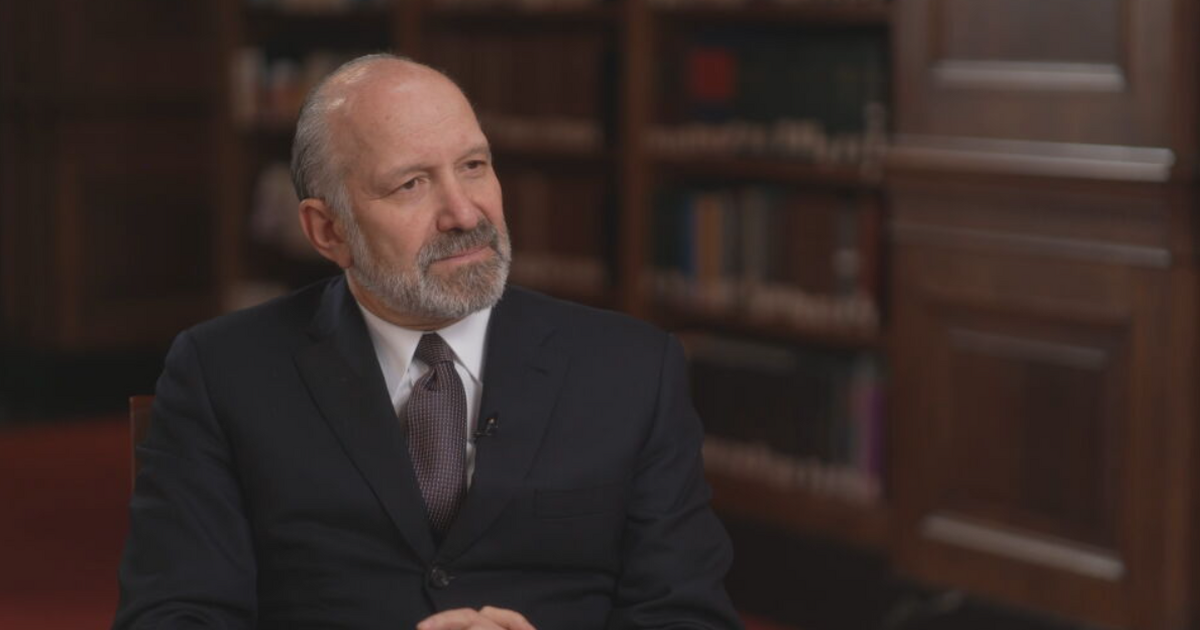

“Two major pillars of his coverage proposals, price lists and mass deportations, are more likely to motive costs to upward thrust as they’ll make it tougher for companies to supply items,” Jacob Channel, leader economist at LendingTree, advised CBS MoneyWatch.

Trump’s plan to levy a ten% tariff on all imports and 60% or extra on Chinese language items shipped to the U.S. may just upload $1,700 a yr in more prices for a standard middle-class family, in line with the non-partisan Peterson Institute for Global Economics.

Trump’s plans may just spice up the inflation fee by means of as a lot 1 share level, bringing it to an annual fee of about 3.4% — above the Fed’s 2% purpose — in line with Andrzej Skiba of RBC World Asset Control.

“In the event you upload 1% to subsequent yr’s inflation numbers, we will have to say bye to fee cuts,” Skiba stated.

May the financial system develop quicker?

The financial system may just first of all develop quite quicker below Trump’s plans to chop company taxes, however that affect may just fade over the years, particularly because of the affect of deporting thousands and thousands of immigrants, in line with Oxford Economics.

Actual GDP expansion may well be 0.3 share issues upper in 2026 than if present financial insurance policies endured, wrote Ryan Candy, leader U.S. economist at Oxford Economics, in a November 6 analysis observe.

However, he added, GDP expansion may just ultimately fall to 0.6 share issues decrease in 2028 than previous projections because of the affect of deportations and better price lists.

Will housing grow to be extra inexpensive?

Most probably now not, in line with Shiny MLS leader economist Lisa Sturtevant.

First, if Trump’s plans reignite inflation as some economists are forecasting, the Federal Reserve won’t proceed reducing its benchmark fee. With out additional cuts in borrowing prices for customers and companies, loan charges are not more likely to fall, she added.

2nd, deporting thousands and thousands of undocumented immigrants may just affect the housing sector — which already faces a serious scarcity of houses — as it will depend on those staff to construct new houses, Sturtevant stated.

“His mass deportation proposal would have a chilling impact at the building business, shrinking the already constrained hard work pressure and stalling badly wanted new housing building,” she stated. “On the similar time, proposed price lists will build up construction prices.”

Will Trump’s insurance policies assist your 401(okay)?

Perhaps, for the reason that Trump’s proposed company tax cuts and fortify for lighter laws on companies, if enacted, may just bolster corporate income and raise the inventory marketplace.

On Wednesday, indices together with the S&P 500 and Dow Jones Commercial Reasonable, soared on Wall Boulevard optimism for more potent company expansion.

“Decrease company taxes and/or deregulation of the power and fiscal sectors below a Trump management may provide further fortify,” Solita Marcelli, leader funding officer Americas, UBS World Wealth Control, stated in an electronic mail.

Different monetary tools may just additionally get a spice up, together with cryptocurrencies, because of Trump’s pledge to make the U.S. the “crypto capital of the planet.”

On the similar time, a lot of those forecasts rely on Trump pushing thru adjustments to the tax code, laws and different rules, Channel famous.

“Just about all of those insurance policies will likely be tricky to put in force, even with Republican keep an eye on over the Area, the Senate and the presidency,” he stated. “With that during thoughts, we would possibly now not see a lot exchange in any respect within the broader financial system.”

He added, “State of being inactive from the following Trump management may just imply that the financial system continues to chug alongside its present direction.”